Ethereum price

in AEDCheck your spelling or try another.

About Ethereum

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Ethereum’s price performance

Ethereum in the news

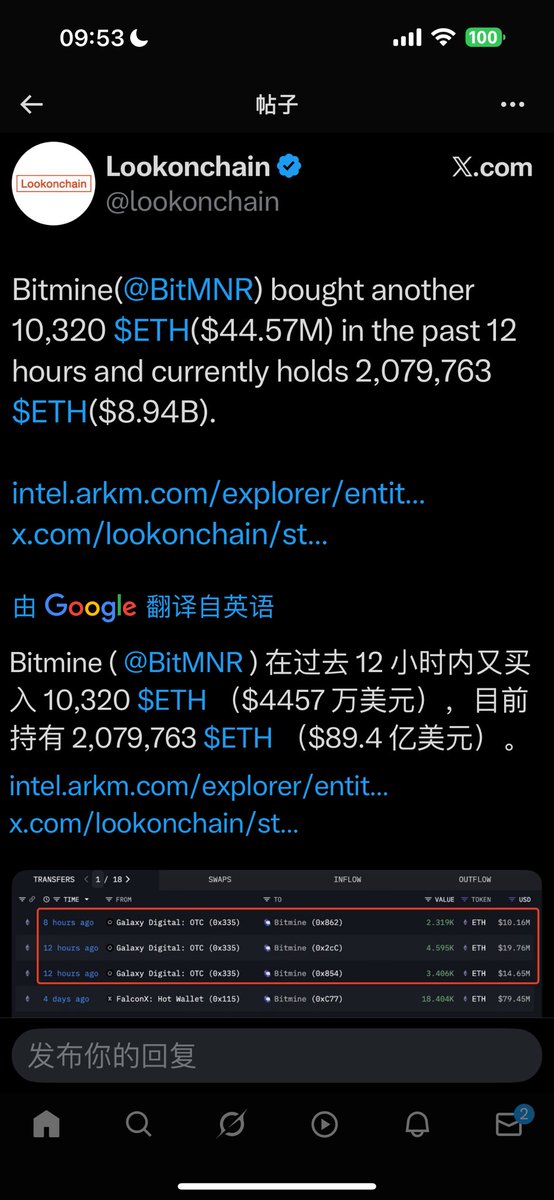

BitMine Immersion Technologies, the largest corporate holder of Ethereum, said Monday it now holds more...

Retail transfers under $250 are at all-time highs, with BSC and Ethereum mainnet gaining ground as Tron falls, according to a fresh report by CEX.io.

Santiment said Bitcoin, Ethereum, Dogecoin, Tether and MultiversX drew the biggest surge in online discussions as crypto markets closed the week.

A surge in staking demand has flipped Ethereum’s validator queues, easing fears of a mass sell-off and reinforcing confidence in long-term ETH staking.

The investor, who originally acquired 1 million ETH during the 2014 ICO for $310,000, still holds 105,000 ETH valued at $451 million in two wallets.

Simple-looking code tapped Ethereum’s blockchain to fetch hidden URLs that directed compromised systems to download second-stage malware.

Ethereum on socials

Guides

Ethereum on OKX Learn

Ethereum FAQ

Ethereum is a decentralized, Layer 1 blockchain platform that allows developers to build and deploy dApps and smart contracts. In addition, since the Ethereum network is a fully decentralized public ledger, accounts can store digital assets such as cryptocurrency or NFTs. It works by using a network of computers to verify and validate transactions on the blockchain, and it uses its native cryptocurrency, ETH, as a means of payment for these transactions.

Ethereum and Bitcoin are decentralized blockchain platforms but have different features and use cases. Ethereum is designed for building and deploying decentralized applications, while Bitcoin is primarily used as a store of value or medium of exchange. Both cryptocurrencies have advantages and disadvantages, and buying either depends on your portfolio goals and risk tolerance.

Easily buy ETH tokens on the OKX cryptocurrency platform. Available trading pairs in the OKX spot trading terminal include ETH/USDT, ETH/USDC, ETH/DAI, and ETH/BTC.

You can also buy ETH with over 99 fiat currencies by selecting the "Express buy" option. Other popular crypto tokens, such as Bitcoin (BTC), Tether (USDT), and USD Coin (USDC), are also available.

Alternatively, you can swap your existing cryptocurrencies, including XRP (XRP), Cardano (ADA), Solana (SOL), and Chainlink (LINK), for ETH with zero fees and no price slippage by using OKX Convert.

Another way you can purchase ETH tokens is via the OKX P2P Trading platform. P2P trading allows users to buy and sell cryptocurrencies directly from other users without needing a middleman.

To view the estimated real-time conversion prices between fiat currencies, such as the USD, EUR, GBP, and others, into ETH, visit the OKX Crypto Converter Calculator. OKX's high-liquidity crypto exchange ensures the best prices for your crypto purchases.

OKX provides a highly secure and multi-chain OKX Web3 Wallet with all OKX accounts. It can safely store BTC or any other cryptocurrency for as long as needed. In addition, the OKX Web3 Wallet features bank-grade security and inbuilt access to hundreds of decentralized applications (dApps) and the OKX NFT Marketplace.

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code.

They are used on the Ethereum network to enable the creation of DApps that can execute complex transactions and operations without intermediaries or centralized authorities. Smart contracts can be used for various applications, including financial services, supply chain management, voting systems, etc.

Ethereum 2.0 is a major upgrade to the Ethereum network that aims to improve its scalability, security, and sustainability. It will introduce a new consensus mechanism called Proof of Stake (PoS), replacing the current Proof of Work (PoW) system.

This will make the network more energy-efficient and less susceptible to 51% of attacks. Ethereum 2.0 will also introduce sharding, allowing the network to process more transactions in parallel and improve its overall scalability.

ERC-20, ERC-721, and ERC-1155 are all token standards on the Ethereum network, but they have different features and use cases. For example, ERC-20 tokens are fungible tokens that are identical and interchangeable with each other. They are commonly used for initial coin offerings (ICOs) and as utility tokens for decentralized applications.

ERC-721 tokens, on the other hand, are non-fungible tokens that are unique and indivisible. They are commonly used for creating digital collectibles, gaming items, and other unique assets.

Finally, ERC-1155 is a hybrid token standard that allows for the creation of fungible and non-fungible tokens within the same contract.

Ethereum is one of the most widely used and well-established blockchain platforms, but it faces competition from newer platforms like Polkadot, Cardano, and Solana. Each of these platforms has its own unique features and strengths.

For example, Polkadot is focused on interoperability between different blockchain networks, while Cardano is focused on scalability and sustainability.

Solana is known for its high-speed transaction processing and low fees. Ultimately, the choice of which platform to use depends on the specific needs and goals of the project or application.

Dive deeper into Ethereum

Ethereum (ETH) is an open-source, decentralized blockchain network that builds on Bitcoin's blockchain innovation, with some significant differences and improvements. Its native coin, Ether, can be used for digital payments and functions as a software platform for creating and deploying immutable decentralized applications (DApps) or smart contracts.

Ethereum is the second largest cryptocurrency by market capitalization, second only to Bitcoin. Ethereum changed the cryptocurrency industry by introducing smart contract functionality to blockchain networks. Smart contracts allow users and developers to access emerging industries like decentralized finance (DeFi).

Because of the seemingly limitless possibilities of blockchain technology and smart contract functionality, Ethereum has produced several multi-billion dollar industries. These include DeFi, play-to-earn crypto gaming, and the wildly popular non-fungible token (NFT) industry. Today, the Ethereum blockchain is home to over 2,900 different projects and has processed over $11 trillion in value.

Like stablecoins, including Tether (USDT) and USD Coin (USDC), Ethereum's native token, Ether, is used to pay transaction fees when completing transactions on the network. It's also a currency exchange for digital assets stored on the blockchain, like NFTs. Following the Ethereum Merge, ETH will be used to secure the network and produce new blocks.

What sets Ethereum apart?

The Ethereum network is designed to serve as a global computer that anyone can use. It aims to give users complete control of their digital assets and allow them to access tools and services traditionally controlled by centralized entities.

For example, on the Ethereum blockchain, anyone can provide digital assets as collateral and take out an instant loan. In the traditional finance world, this process would be governed by the jurisdiction of a centralized company. With Ethereum, every aspect of this function is handled entirely by smart contracts on the blockchain. This removes the requirement for partial intermediaries.

The blockchain can also make any program censorship-resistant, robust, and less vulnerable to fraud by running and offering it on a distributed network of worldwide public nodes.

In the spirit of decentralized ownership, anyone can submit governance proposals that they believe can improve Ethereum for the collective good of the project. After a proposal is submitted, holders of the Ether token can vote on its outcome. By doing so, the Ethereum community is responsible for guiding developments to the network.

How does ETH work?

When the Ethereum blockchain was initially launched in 2015, it employed a Proof of Work (PoW) consensus algorithm. In this model, new ETH tokens were created and distributed to miners as rewards for producing new blocks and securing the network.

This means that high-powered computational hardware installations, called mining rigs, compete against each other to solve complex equations in the mining process. The first miner to solve the equation earns the right to lead the production of new blocks on the network and is rewarded with new tokens as an incentive. This is also the same model employed by the Bitcoin network.

The Ethereum blockchain also has an account-based architecture. An Ethereum account is essentially an entity that holds an Ether balance and can initiate transactions on the Ethereum blockchain. There are two types of Ethereum accounts.

The first is "external accounts", which users control and manage through their private keys. The second is "contract accounts", known as smart contracts, and it's governed by code. Both these accounts can hold, receive, and send ETH and other Ethereum tokens and interact with smart contracts deployed on the blockchain.

External accounts can initiate transactions with other external accounts and smart contracts. The smart contracts kick in only when interacting with external accounts or other smart contracts. They can only respond by triggering code (involving multiple actions), transferring tokens, or even creating new smart contracts.

Ethereum's technology

Unlike Bitcoin, which uses a distributed ledger, Ethereum employs a distributed "state machine." Ethereum's "state" at any given point is a large data structure incorporating accounts and balances and the "machine's state" at that time.

It also encompasses the ability to host and execute many low-level machine code. This "state" keeps changing from block to block, and the Ethereum Virtual Machine (EVM) defines the rules for changing it.

The Ethereum network has a host of use cases, with the ability to create and deploy smart contracts being central to all of them. This functionality allows developers to produce various decentralized applications on the platform, including crypto wallets, decentralized exchanges (DEX), DeFi protocols, NFT marketplaces, play-to-earn games, and more.

Ethereum token standards

Ethereum’s token standards, like ERC-20 and ERC-721, have been extensively used to create fungible and non-fungible tokens, therefore contributing to various multi-billion-dollar projects. ERC-721 standard-based NFTs, in particular, pioneered the NFT industry, which had a global market cap of $75.89 billion as of May 2024.

ERC-1155 is a token standard on the Ethereum blockchain that allows for the creation of fungible (identical) and non-fungible (unique) tokens within the same contract. This makes it a more efficient and flexible solution for developers to create and manage multiple types of tokens simultaneously. Meanwhile, ERC-777 brought "Hooks" to the Ethereum network. Hooks is a function that bundles the action of sending tokens and notifying a contract into one message, improving the efficiency of smart contracts. ERC-777 is also backward-compatible with the ERC-20 standard, which helps extend the functionality of ERC-20.

Any time users transfer ETH or Ethereum-based tokens or interact with any application hosted on the platform, they must pay ETH as gas fees. In the future, ETH will also be used for validation purposes on the new Proof of Stake (PoS) Ethereum blockchain, with active validators required to stake 32 ETH to qualify for the job.

What's the Ethereum Virtual Machine (EVM)?

Introduced in 2015, the Ethereum Virtual Machine (EVM) is the Ethereum blockchain's heart. EVM is the environment where all the Ethereum accounts and smart contracts reside. It's a computation engine — also known as a virtual machine — that functions like a decentralized computer housing millions of executable projects.

In other words, EVM makes up the bedrock of Ethereum's complete operating structure. As a single entity, EVM is simultaneously maintained by thousands of interconnected computers (nodes) running an Ethereum client.

What's the Ethereum Merge?

As Ethereum's demand grew, the network's core architecture also started showing signs of congestion, and the average gas fee per transaction rose significantly. Hence, one of the Ethereum blockchain's biggest challenges is its exorbitant gas fees at times of high network congestion. For example, in May 2021, the average cost for a basic transaction on the network was around $71.

Formerly known as Ethereum 2.0, the Ethereum Merge is a multi-year event that gradually moves the Ethereum blockchain from its PoW to the PoS consensus mechanism. While the transition will not instantly solve the high gas fees problem, it will make Ethereum a more environmentally friendly and efficient blockchain network.

In the PoW system, Ethereum miners compete with each other, using expensive computational resources, to add new blocks to the chain and earn ETH rewards in return. In the PoS model, however, they'll no longer need to mine the blocks.

Instead, they'll create and add new blocks when chosen to do so and validate others' blocks when not. To earn the right to become a validator, they must stake 32 ETH with the network. Furthermore, since there will be no competition between validators, they'll no longer require expensive and advanced hardware like mining rigs for the job.

Although the Ethereum team has been planning this transition since 2016, it initiated the process with its PoS Beacon Chain launch on December 1, 2020.

This marked phase zero of a three-phase process that will see Ethereum transitioning from a singular PoW chain to a multi-chain PoS network. Below are these three phases and how they intend to transform Ethereum.

Phase 0 (Beacon Chain)

This involved the launch of Beacon Chain, a PoS blockchain running parallel to the original PoW Ethereum mainnet. In addition, it laid the groundwork for future upgrades to Ethereum. As of writing, over 410,000 validators on Beacon Chain have staked over 13 million.

Phase 1 (The Merge)

Executed on September 15, 2022, The Merge involved merging the Beacon Chain with the existing Ethereum blockchain, entirely replacing the latter's PoW model with the former's PoS system. Post Merge, the original Ethereum blockchain has become the new network's "execution" layer, while the Beacon Chain has become its "Consensus" layer.

Phase 2 (Sharding)

Sharding was supposed to be the second and final phase of the Merge. The plan was to spread the network's load across 64 new shard chains. The current PoW Ethereum chain would have become one of the 64 shards, simplifying the process of running a mining node by reducing the data load. However, this plan was dropped from the roadmap due to the positive impact Layer-2 rollups have had on the network's scalability.

Instead, Ethereum Improvement Proposal (EIP)-4844 — also known as Proto-Danksharding — was introduced on March 13, 2024 as part of the Dencun Upgrade. One of Ethereum's most significant developments to date, the Dencun Upgrade was designed to reduce transaction costs and improve overall data throughput on the network. Proto-Danksharding supports the scalability fixes brought by Ethereum's various Layer-2 solutions, making it an adequate replacement for the shard chains originally proposed for phase two of the Ethereum Merge. Meanwhile, the Dencun Upgrade also brought 'blobs' to the network as an additional solution to Ethereum's scalability limitations. Blobs are large data structures that allow transactions to be settled at Layer-2, streamlining the network's operations and supporting future scalability improvements.

ETH price and tokenomics

In July 2014, the Ethereum Foundation launched the ETH initial coin offering (ICO). During this public sale event, roughly 60 million ETH was distributed to buyers at an initial exchange rate of 2000 ETH to 1 BTC. At the time, the Ethereum price was at approximately $0.31. Ether tokens were distributed to buyers at the genesis block of the Ethereum network.

When the Ethereum mainnet was launched, the initial supply of ETH tokens was approximately 72 million. While most of these tokens were allocated to early supporters, 16.73 percent of the supply was distributed to the Ethereum Foundation.

Since the genesis block of the Ethereum mainnet, roughly 48 million ETH has been added to the supply via token generation. New ETH tokens are generated and distributed to miners via block rewards, making Ethereum an inflationary cryptocurrency. While the EIP-1559 London Hard Fork update introduced some deflationary mechanics, these currently don't entirely offset the Ethereum inflation.

Emissions of Ethereum block rewards have been steadily declining over time. When the network was launched, new Ether was produced at 5 ETH per block. These rewards were given to miners as an incentive for securing the network and validating transactions. In October 2017, as part of the EIP-649 proposal, this emission rate was reduced to 3 ETH per block.

The ETH price reached its all time high of $4,878.26 on November 10, 2021, at the tail end of a bull market. 2022 saw the arrival of a protracted bear market for crypto, which lead the Ethereum price from its all time high down as low as $1,049.23 before the end of June 2022. The Ethreum price recovered but remained volatile into and throughout 2023, until the closing months of the year brought positive sentiment and a fresh bull market, helped by the arrival of a Spot Bitcoin ETF in January 2024. Following the Spot Bitcoin ETF's approval, there was much speculation around the possibility of an imminent Spot Ethereum ETF, which helped fuel an ETH price rise to $3,890 in early March 2024.

About the Spot Ethereum ETF

The possibility of a fully approved spot Ethereum ETF took a major step forward on May 23, 2024 when the U.S. Securities and Exchange Commission (SEC) approved issuers' 19b-4 filings. This development followed a remarkable about-turn in the spot ETH ETF story, as many commentators were bearish on the possibility of approval during 2024. The green light on the 19b-4 filings is by no means the final hurdle. Next, the SEC must approve issuers' S-1 filings before funds can be openly offered to interested traders. It's unclear when this final approval will occur, but many expect the process to take weeks or months.

Interest around a potentially sudden Spot ETH ETF approval brought additional volatility to ETH prices. Before the May 23 decision, the Ethereum price had already rallied by 25% in a 24-hour period during May 2024.

About the founders

The idea of Ethereum was initially described through a whitepaper written by Vitalik Buterin in late 2013, when he was just 19 years old. Before conceptualizing Ethereum, Buterin was an experienced programmer and developer who'd previously founded the Bitcoin Magazine news site.

Buterin believed that blockchain technology could be leveraged to build decentralized protocols and applications free from the control of central bodies. Buterin was an avid player of World of Warcraft, a popular online game. After its creators removed his favorite spell from the game, Vitalik decided that no single entity should have complete control over an application, thus forming the conception of the Ethereum blockchain.

Ethereum was officially announced in Miami, in January 2014, at the North American Bitcoin Conference. A group of eight individuals co-founded the project.

Russian-Canadian Vitalik Buterin was the most significant contributor and remained so. Gavin Wood of Polkadot (DOT) was the first Chief Technology Officer of the Ethereum Foundation. He coded Ethereum's first technical implementation in C++ programming language and created Solidity, the de facto programming language for creating Ethereum smart contracts.

Today, Solidity is considered the essential programming language for Ethereum applications and enjoys widespread usage on other blockchains that operate an EVM. In addition, Wood found his own alternative blockchain network Polkadot, which aims to remedy some of Ethereum's issues.

Another notable co-founder who is known for building other Layer 1 blockchains is Charles Hoskinson. Hoskinson eventually left the Ethereum project due to differences of opinion on the project's direction. However, he founded IOHK with Jeremy Wood, another early Ethereum colleague, and went on to develop the Cardano (ADA) blockchain.

ESG Disclosure