Ethena price

in USD$0.6659

-$0.0303 (-4.36%)

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Market cap

$4.58B #26

Circulating supply

6.89B / 15B

All-time high

$0.7218

24h volume

$513.91M

About Ethena

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Ethena’s price performance

Past year

--

--

3 months

--

--

30 days

--

--

7 days

--

--

Ethena in the news

Ethena's proposed stablecoin promises to return 95% of revenue to Hyperliquid’s ecosystem.

Ethena has partnered with Binance to integrate its USDe stablecoin across Binance’s platform, which serves...

Listing the protocol's USDe token on major exchanges like Binance is a key requirement to enable a mechanism to share protocol revenues with token holders.

The yield earned on the reserve assets would cover the blockchain's sequencer fees, helping keeping the transaction costs low, MegaEth said.

MegaETH has launched its first native stablecoin, USDm, developed in partnership with Ethena, as a...

The funds will be used to acquire an expected 3 billion ENA, according to StablecoinX, a dedicated treasury vehicle for the stablecoin protocol.

Ethena on socials

September 20

Daily update and summary from Nine Brother

✅️ Market Trends

$BTC has pulled back, altcoins are down.

Liquidity decreases over the weekend, be cautious of market fluctuations.

✅️ Market Highlights:

1⃣ ASTER skyrocketed to 0.94, now listed on Binance Alpha, the community is FOMOing as this is Binance's pawn in on-chain contracts.

2⃣ FTT has risen for 3 consecutive days, FTX will initiate the third round of creditor repayments on September 30, totaling $1.6 billion.

3⃣ ENA has pulled back for nearly 10 days, but yesterday YZi Labs announced an increase in its stake in Ethena Labs and is advancing its expansion on the BNB chain.

4⃣ Bitcoin treasury company Empery Digital signed a new $50 million loan agreement to repurchase shares.

5⃣ Is Sun Brother again the market terminator? Yesterday he promoted the creation of SunPerp, with all income used to repurchase SUN tokens, #SUN has recently risen by 20%.

🚨 A collection of Crypto explosive information from last night, 1 point to get market focus!

1⃣ #BTC, #ETH, and #SOL fell and pulled back, but the three major U.S. stock indexes collectively closed higher, perhaps because Crytpo's funds are more sensitive, and the recent sentiment is high, and profit-taking orders are smashed. Weekend liquidity decreases, pay attention to the painting market.

2⃣ #ASTER has risen sharply to 0.94 against the sky and is currently listed on Binance Alpha, with community FOMO This is a pawn of Binance's on-chain contract.

3⃣ #FTT After rising for three consecutive days, FTX will launch the third round of creditor repayments on September 30, totaling $1.6 billion.

4⃣ #PUMP. #hype When the leader continues to pull back from the high point and the leader cannot rise, pay attention to the overall emotional pullback risk.

5⃣ #ENA has pulled back for nearly 10 days, but yesterday YZi Labs announced that it would increase its stake in Ethena Labs and promote its expansion on the BNB Chain.

6⃣ Brother Sun is the market terminator again? Yesterday, it was advertised to build SunPerp, and all the proceeds were used to buy back SUN tokens, #SUN it has recently risen by 20%.

7⃣ #MetaMask will launch perpetual contract trading through Hyperliquid in the wallet, and the new feature of Xiaohu Wallet must be used, perhaps with airdrop weight.

8⃣ BitGo, a cryptocurrency custodian company, has officially filed S-1 documents with the U.S. SEC, initiating the IPO process. Founded in 2013, BitGo is one of the largest cryptocurrency custodians in the United States.

9⃣AI market prediction: The market as a whole shows a fierce game of long and short, BTC and ETH capital flows are frequent, there is short-term pullback pressure but medium-term bullish expectations are still the same, the BNB ecosystem and stablecoin sector are active, mainstream currencies fluctuate in the short term, funds prefer high-leverage fast in and out operations, market sentiment is cautious and highly divided.

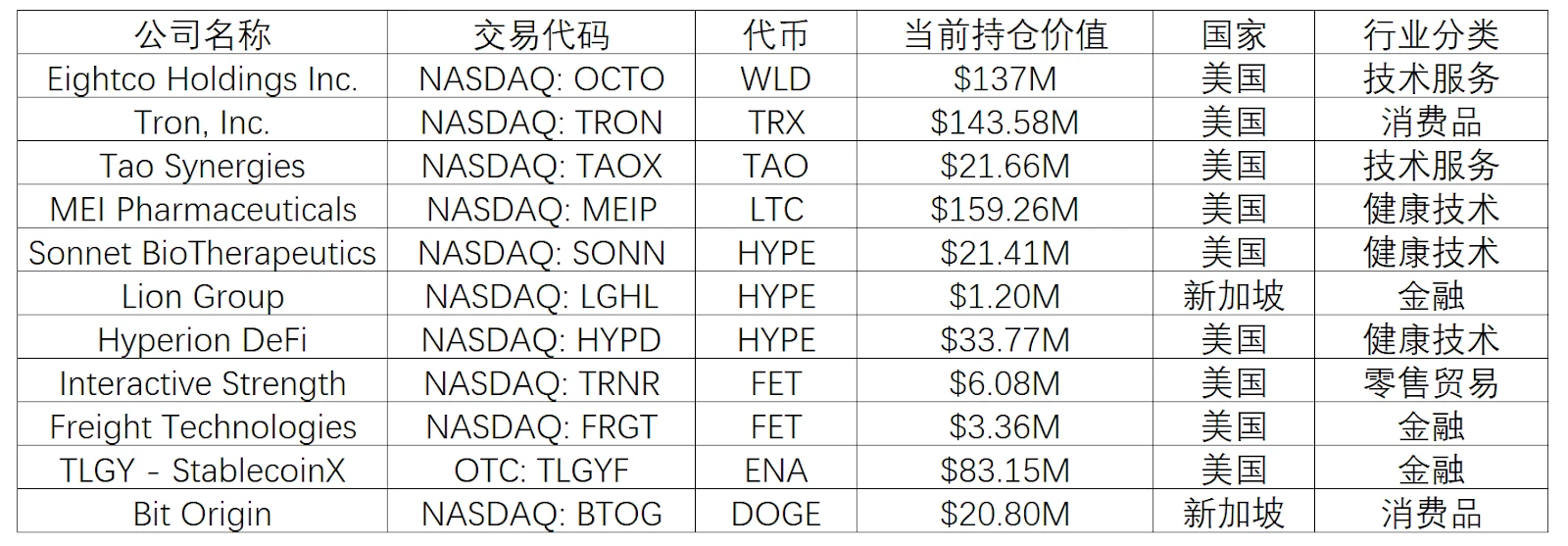

From the treasury, the wind direction: which copycats are being paid for by enterprises in 2025

If the market is a thermometer of emotions, then "treasury allocation" is the voting device of enterprises. Who puts real money on the balance sheet and bets on which altcoins are often more reliable than the buzz of social media. In 2025, we will see more and more listed companies incorporating non-BTC and non-ETH tokens into their treasuries in public disclosures, such as FET and TAO in the AI track, HYPE and ENA in the new DeFi infrastructure, as well as payment veterans LTC and TRX, and even DOGE with a stronger community color. Behind these positions, there is both business synergy and asset diversification, which gives ordinary investors a window to "see the wind direction": who buys, why buys, and how to use it after buying. Starting from these questions, it will be easier for you to distinguish between strong and weak narratives, and understand which copycats are being taken seriously by "institutionalized funds".

Why look at the treasury allocation?

Use "real money of the enterprise" to identify strong narratives. First, because it is more difficult to fake. Once a company writes tokens into financial reports or regulatory documents, it means that management has to explain the size of the position, accounting policies, custody and risk, which is more binding than "shouting slogans". Second, it is closer to "using and holding". In this treasury wave, many companies not only buy tokens, but also sign technical cooperation, introduce tokens as products or do on-chain staking income, such as Interactive Strength plans to purchase about $55 million in FET and cooperate with fetch.ai signs, Freight Technologies binds FET to logistics optimization scenarios, and Hyperion DeFi uses HYPE for staking and collaborates with Kinetiq Opening up the yield and collateral path, TLGY (proposed to be merged into StablecoinX) plans to establish an ENA treasury betting on Ethena's synthetic stability and yield structure. What these actions have in common is that tokens are not only prices, but also "certificates" and "fuel". Third, it provides an alternative path for ordinary investors. You can research tokens directly or gain "indirect exposure" by researching publicly traded companies that hold them. Of course, this is a double-edged sword: small market capitalization companies superimpose high-volatility tokens, and their stock prices often become "token agents", and the rise and fall will be more violent. If you take the path of "indirect exposure to stocks", position control and rhythm are particularly important.

This trend is accelerating from the market context of 2025. On a macro level, the implementation of spot crypto ETFs in the United States has increased risk appetite, and the strength of BTC and ETH has given altcoins a "point-to-surface" spillover window, and the high-quality track has gained more attention. The attitude of the company is also changing: from "tentative holding" a few years ago to "strategic allocation", and even a new species of "crypto treasury as the main business" has emerged - some companies have taken the initiative to transform and clearly regard the construction and operation of crypto treasury as the main line business. At the disclosure level, companies are no longer satisfied with press releases, but more through regulatory documents, quarterly reports, and investor presentations to disclose position size, fair value, custody details, and risk control arrangements, and the verifiability of information is increasing. In short, the heat is back, the path is clearer, and the funds are starting to be more "serious". This also means that observing treasury dynamics is becoming a reliable window into the direction of the industry.

Statistics on recent altcoin holdings of listed companies

Three main lines of altcoins: AI, new DeFi and payment old coins

AI track (FET, TAO): The key signal of this main line is "use and hold". The tokens of AI-native networks are often not simply speculative targets, but the "tickets and fuel" for access and settlement: the call of intelligent agents, the access to the computing power and model market, and the network incentive mechanism all require endogenous use of tokens. The entry of enterprise treasury is often accompanied by technical cooperation and business integration, such as the formation of a closed loop in logistics optimization, computing power call or intelligent agent landing, so the speculative weight is relatively low and more strategic allocation. However, there are also uncertainties in this track: the combination of AI and blockchain is still in the verification stage, valuations may reflect future expectations in advance, and the long-term sustainability of the token economy (inflation/deflation mechanism, incentive model, fee recovery) still needs to be observed.

New DeFi infrastructure (HYPE, ENA): This track is a combination of "efficiency + income". HYPE represents a performance-oriented DeFi infrastructure: it carries derivatives trading and staking derivatives through a high-performance chain, forming a capital cycle of "earning income + liquid staking and re-staking", providing an efficient utilization path for institutions and capital pools. The interest of corporate treasury is that it can not only bring on-chain governance and income, but also enhance liquidity and market stickiness through capital circulation.

ENA's appeal is more focused on the design of synthetic stability and hedging returns. By combining staking derivatives and hedging strategies, Ethena attempts to create "dollar-like" stable assets without relying on the traditional banking system and endogenously generate a source of income. If this model can be connected with exchanges, custodians and payment sides, it may form a truly closed-loop "crypto dollar + income" system. For corporate treasuries, this means holding a stable unit of account while also providing income and tools to hedge against volatility. However, the risks are also more complex: clearing security, robustness of smart contracts, and stability in extreme market conditions are all key points that require high-intensity audits and risk control.

Source: X

Payment and established market (LTC, TRX, DOGE): In contrast, this group of assets is more inclined to "worry-free bottom positions and payment channels". They have a longer history, stronger liquidity, and better infrastructure, so they are convenient to become a "cash-like" allocation for corporate treasuries, which can meet both long-term stores of value and payment scenarios. The efficiency advantages of LTC and TRX at the payment and settlement layers make them direct payment exposure for treasuries; DOGE, on the other hand, has unique value in light payments and topic communication with its community and brand spillover effects. Overall, the role of this type of asset is more robust and fundamental, but the new growth story is limited, and the future may be more under competitive pressure from stablecoins and L2 payment networks.

Know what to buy, but also know how to look at it

See the direction of the wind, but don't make simple analogies. Which token a company writes into its financial report is equivalent to voting with real money, which can help us filter out a lot of noise, but it is not a universal indicator. A more comprehensive observation framework looks at three levels at the same time: whether there is business collaboration (does the company really use this token), whether there is formal disclosure (written into regulatory documents, explaining how much was bought, how to keep it, and what are the risks), and whether the on-chain data can keep up (activity, transaction depth, and whether liquidation is stable). The true value of corporate treasury allocation lies not in providing investment advice, but in revealing the underlying logic of industry evolution - when traditional listed companies begin to allocate specific tokens on a large scale, this reflects the structural transformation of the entire crypto ecosystem from "pure speculation" to "value anchoring".

From a macro perspective, this wave of treasury allocation marks the intersection of three important trends: the maturity of the regulatory environment - companies dare to disclose their crypto asset holdings in public documents, indicating that a compliance framework is being established; The materialization of application scenarios is no longer an abstract "blockchain revolution" but quantifiable business needs such as AI training, DeFi income, and cross-border payments. Institutionalization of capital structures – from retail led to corporate participation – means longer holding cycles and more rational pricing mechanisms. The deeper meaning is that treasury allocation is redefining the essence of "digital assets". In the past, we used to think of cryptocurrencies as high-risk speculative tools, but as more and more companies use them as operational assets or strategic reserves, they begin to have attributes similar to foreign exchange reserves, commodity inventories, or technology licenses. This shift in perception may be more disruptive than any technological breakthrough.

Guides

Find out how to buy Ethena

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict Ethena’s prices

How much will Ethena be worth over the next few years? Check out the community's thoughts and make your predictions.

View Ethena’s price history

Track your Ethena’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Ethena on OKX Learn

What is Ethena (ENA): is synthetic dollar USDe a DeFi revolution?

From decentralized exchanges exploring revenue sharing to Bitcoin Layer 2s establishing themselves as viable scaling solutions, the DeFi landscape is continuing to innovate and offer exciting alternat

ENA and USDT: Exploring Ethena's Dual-Token Strategy and USDe's Market Growth

Introduction to ENA and USDT in Ethena's Ecosystem Ethena, a rising innovator in the cryptocurrency space, has gained significant attention for its dual-token system, featuring the governance token EN

Ethena ($ENA): Key Insights, Whale Activity, and Price Forecast You Need to Know

Introduction to Ethena ($ENA) and Its Growing Influence in DeFi Ethena ($ENA) has rapidly emerged as a key player in the decentralized finance (DeFi) ecosystem, gaining traction for its innovative sol

Bull Market Insights: Ethena and Hyperliquid's Ecosystem Growth and Innovations

Introduction to Ethena and Hyperliquid in the Bull Market The cryptocurrency market is experiencing a bullish phase, with innovative projects like Ethena (ENA) and Hyperliquid (HYPE) leading the charg

Ethena FAQ

Currently, one Ethena is worth $0.6659. For answers and insight into Ethena's price action, you're in the right place. Explore the latest Ethena charts and trade responsibly with OKX.

Cryptocurrencies, such as Ethena, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Ethena have been created as well.

Check out our Ethena price prediction page to forecast future prices and determine your price targets.

Dive deeper into Ethena

ENA is the governance token of Ethena, a synthetic dollar protocol built on Ethereum that provides a crypto-native solution for money.

Market cap

$4.58B #26

Circulating supply

6.89B / 15B

All-time high

$0.7218

24h volume

$513.91M