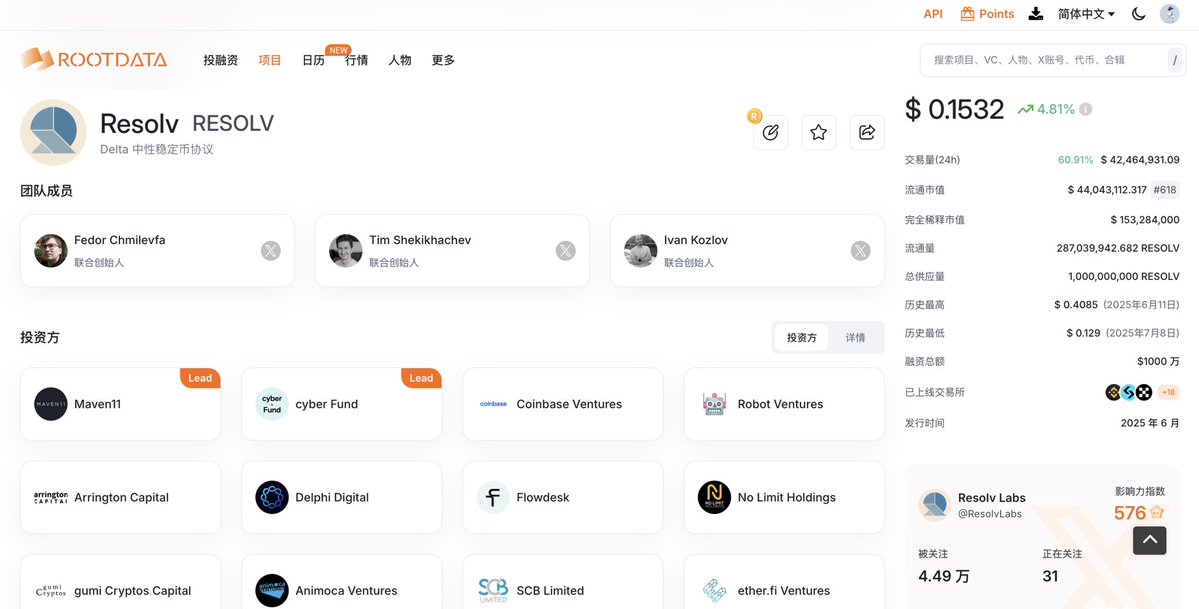

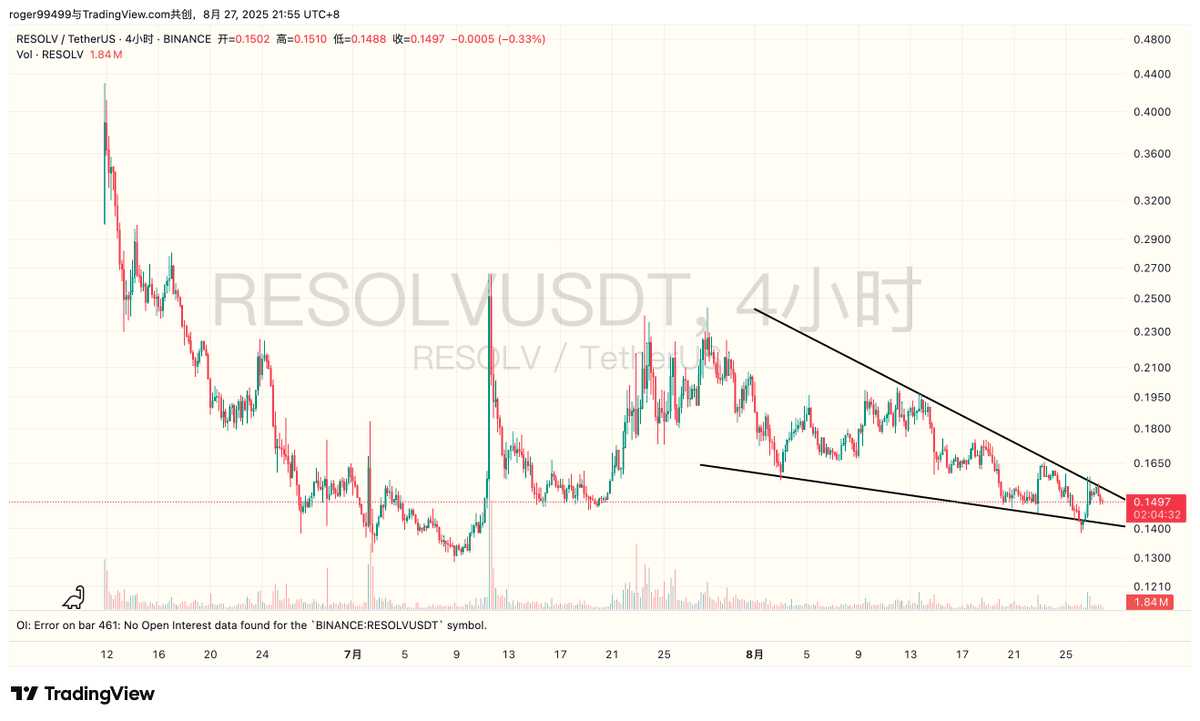

⚡️Resolv Project Research Report: Buyback Mechanism Drives Value Reassessment, overall $Resolv is worth paying attention to @ResolvCore Recently, I came across the Resolv project. Despite its TVL exceeding $549 million, its market cap is only around $43 million, significantly undervalued compared to similar projects Usual ($USD0) / Ethena ($ENA). Resolv has secured $10 million in seed funding, supported by top VCs like Coinbase Ventures and Delphi Labs. With a TVL exceeding $549 million, it is integrated into mainstream DeFi platforms such as Morpho, Pendle, Euler, and Uniswap. It has already distributed over $20 million in real returns to users, with a total minting/redemption amount exceeding $1.7 billion. 1. Buyback Mechanism On August 26, the Resolv Foundation announced the initiation of a buyback program, initially allocating 75% of core protocol fees for weekly buybacks of $RESOLV tokens on the open market, with subsequent buyback ratios to be dynamically adjusted based on...

$Resolv has initiated a buyback program to further ensure the value of the token.

Based on the current $500M+ TVL, the real yield range of 9-15.5% APR, Resolv's annual net income is expected to exceed $7.3M.

If 75% is used for buybacks initially, then for the current ~$45M MCAP, it is already close to the logic of high-dividend value stocks.

Additionally, with RESOLV's $500M TVL, the ratio to MC is 0.09x, which is far lower than ENA's 0.3x and USUAL's 0.12x. Resolv is severely undervalued in terms of multiples under the same business model.

Delphi and Coinbase Ventures have already placed their bets, and what’s next is market discovery + buyback realization.

19.91K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.