ZKsync price

in USDCheck your spelling or try another.

About ZKsync

Disclosures

ZKsync risk

This material is for informational purposes only and is not exhaustive of all risks associated with trading ZKsync. All crypto assets are risky, there are general risks in investing in ZKsync. These include volatility risk, liquidity risk, demand risk, forking risk, cryptography risk, regulatory risk, concentration risk & cyber security risk. This is not intended to provide (i) investment advice or an investment recommendation; (ii) an offer or solicitation to buy, sell, or hold crypto assets; or (iii) financial, accounting, legal or tax advice. Profits may be subject to capital gains tax. You should carefully consider whether trading or holding crypto assets is suitable for you in light of your financial situation. Please review the Risk Summary for additional information.

Investment Risk

The performance of most crypto assets can be highly volatile, with their value dropping as quickly as it can rise. You should be prepared to lose all the money you invest in crypto assets.

Lack of Protections

Crypto assets are largely unregulated and neither the Financial Services Compensation Scheme (FSCS) nor the Financial Ombudsman Service (FOS) will protect you in the event something goes wrong with your crypto asset investments.

Liquidity Risk

There is no guarantee that investments in crypto assets can be easily sold at any given time.

Complexity

Investments in crypto assets can be complex, making it difficult to understand the risks associated with the investment. You should do your own research before investing. If something sounds too good to be true, it probably is.

Concentration Risk

Don't put all your eggs in one basket. Putting all your money into a single type of investment is risky. Spreading your money across different investments makes you less dependent on anyone to do well. A good rule of thumb is not to invest more than 10% of your money in high-risk investments.

Five questions to ask yourself

- Am I comfortable with the level of risk? Can I afford to lose my money?

- Do I understand the investment and could I get my money out easily?

- Are my investments regulated?

- Am I protected if the investment provider or my adviser goes out of business?

- Should I get financial advice?

ZKsync’s price performance

ZKsync on socials

Guides

ZKsync on OKX Learn

ZKsync FAQ

Dive deeper into ZKsync

ZKsync is a Layer-2 zero-knowledge (ZK) rollup designed to scale the Ethereum network and reduce the cost of transacting on the blockchain. ZK rollup, which underpins the platform, is a trustless protocol that allows validators to confirm a transaction's authenticity without revealing any information about the transaction. As a result, the protocol preserves user privacy and security on the network while supporting faster and cheaper transaction processing.

Built by Matter Labs, ZKsync is the first zkEVM (Ethereum Virtual Machine) chain. It's designed to "look and feel like Ethereum," according to the project team, to help simplify adoption. Meanwhile, just like Ethereum, smart contracts are written using the Solidity and Vyper smart contract languages, and can be called via the same clients as other EVM-compatible chains.

How does ZKsync work?

ZKsync adopts ZK technology, a cryptographic method used to confirm the proof of a statement while obscuring any information about the statement itself. Think of the technology like an identity card that confirms you're an adult without revealing your actual age, name, or any other personal details.

ZK rollups help to improve the scalability of the Ethereum blockchain by performing computation and state offchain. The solution bundles transactions together at Layer-2 before they're posted on Layer-1. This method allows users to benefit from all the security advantages of Ethereum's base network but with higher throughput and lower fees.

ZKsync is compatible with EVM, and almost every smart contract written for EVM will be supported by the platform. That means most projects can be migrated over to the network with little to no modification.

Why is ZKsync significant?

ZKsync helps to address one of the most pressing limitations of the Ethereum network — scalability. Ethereum's relatively limited transaction throughput can lead to network congestion during periods of high demand, an issue that's only compounded as more users adopt the network. Meanwhile, congestion can lead to high gas fees, making transactions and interactions with decentralized applications costly. High latency is another challenge impacting the network's performance, as transactions are typically confirmed in a relatively slow 13 to 15 seconds.

ZKsync's use of ZK technology helps to ease these limitations while providing a platform that retains Ethereum's robust security and familiar usability. In theory, this should incentivize more developers to adopt Ethereum, strengthening the network's appeal at a time when competing solutions continue to launch.

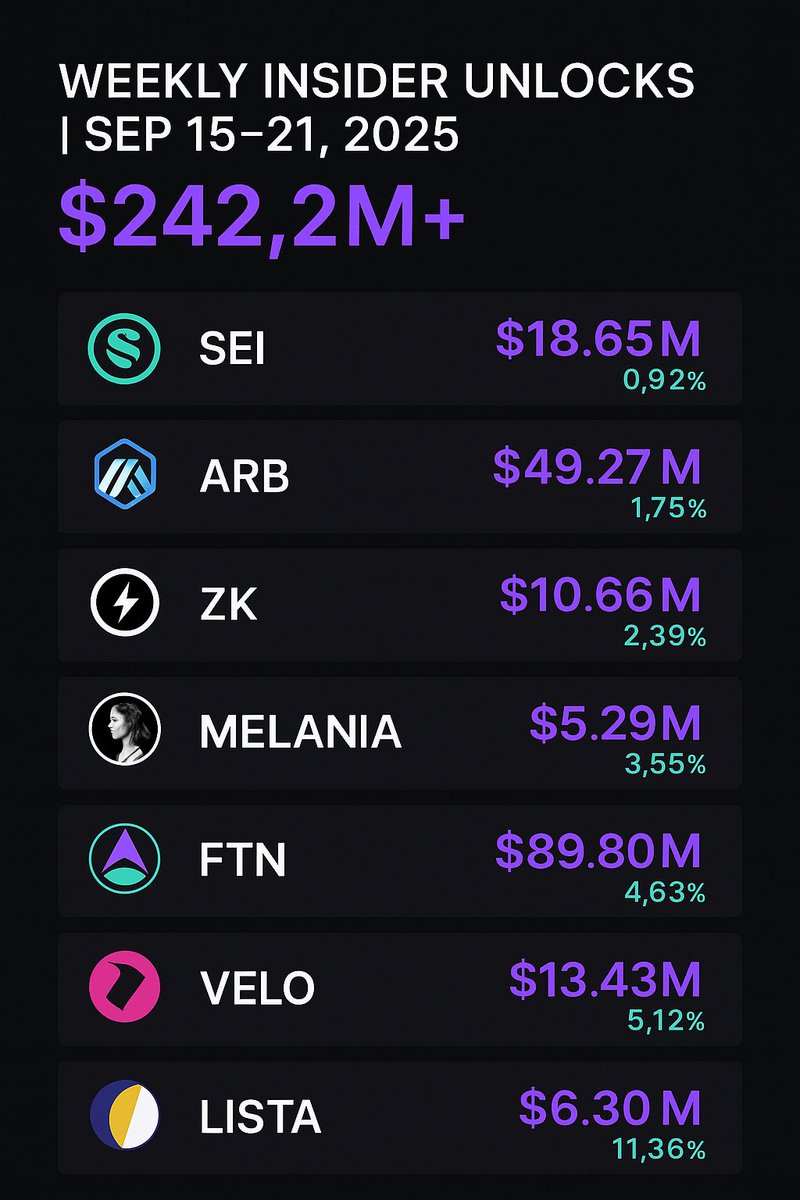

ZK price and tokenomics

The ZK token has a total circulating supply of 21 billion. In June 2024, an airdrop was completed to distribute 17.5% of the token's supply to the project's community. Of the approximately 3.6 billion tokens reportedly airdropped to 695,232 wallets, 89% went to those who'd transacted on ZKsync — although the exact criteria wasn't announced — with 11% going to ecosystem contributors. This included ZKsync native projects, onchain communities, and builders. Meanwhile, 49.1% of the ZK supply will reportedly be distributed through "ecosystem initiatives", while 17.2% will go to investors and 16.1% will be allocated to Matter Labs members.

Due to a lack of liquidity, no ZK price was available as of the June 2024 ZK token airdrop. However, based on existing pre-launch futures available on Aevo, ZK perpetuals look to be trading at about $0.22.

About the ZKsync founders

ZKsync was developed by Berlin-based blockchain developer Matter Labs. The company was founded in 2018 by Alex Gluchowski and Alex Vlasov, and first deployed ZKsync to a closed testnet in December 2021. The platform was made publicly available on the mainnet on March 24, 2023.

The Matter Labs team, comprised of engineers, researchers, and technical experts, has made clear its focus on redrawing the limits of blockchain scalability through zk technology and open source developments. The organization is working towards the mainstream arrival of public blockchains, and is backed by numerous major players in the space, including the Ethereum Foundation.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.